XS Innovations, a spinoff from Delft University of Technology (TU Delft) and Leiden University Medical Center (LUMC), today announced the successful closure of a €1.1 million seed funding round. This investment will accelerate the development of XS Innovations’ revolutionary Dynamic AVF, a state-of-the-art vascular access device designed to address the prevalent complications associated with hemodialysis.

The groundbreaking Dynamic AVF is expected to significantly reduce complication rates and extend the lifespan of vascular access, with the potential to improve outcomes and overall quality of life for ESKD patients. The financing round includes FIRST fund (managed by BGV), Medtech TTT Fund (managed by Innovation Industries), UNIIQ, Delft Enterprises, Libertatis Ergo Holding, and the Graduate Entrepreneur Fund.

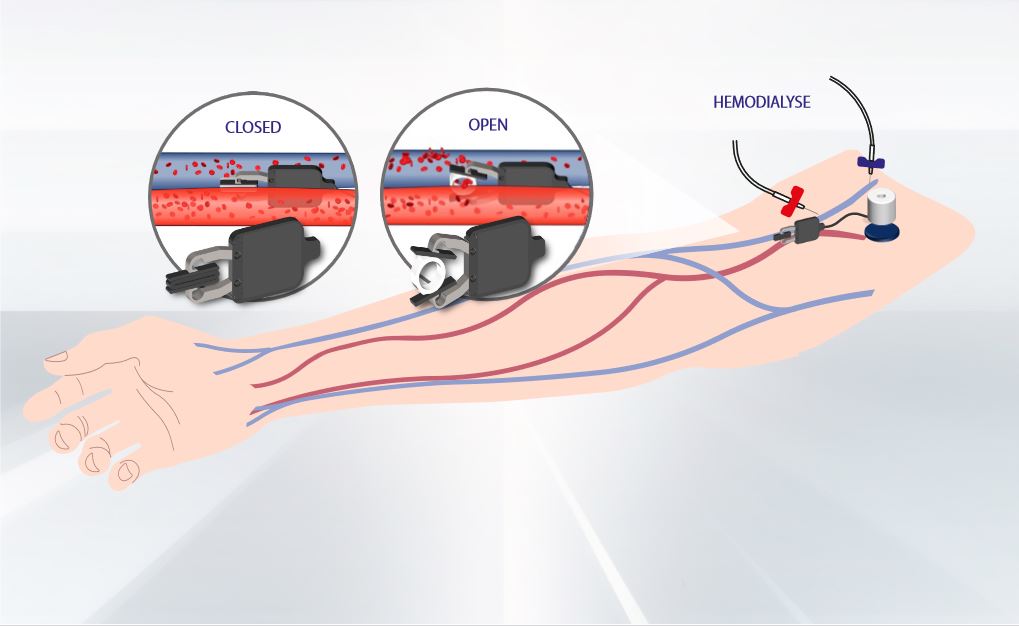

Globally, approximately 4 million patients are affected by end-stage kidney disease (ESKD), with 70% of them relying on hemodialysis as a vital component of their treatment. Unfortunately, the conventional high-flow vascular access sites required for hemodialysis often lead to severe complications, such as vascular access occlusion, heart failure, and steal syndrome. Recognizing this critical need, Dutch-based researchers from Leiden University Medical Center and Delft University of Technology collaborated to develop the Dynamic AVF. Unlike traditional arteriovenous fistulas (AVF), which maintain high blood flow continuously, the Dynamic AVF connects the artery and vein only during dialysis, while keeping the AVF closed during the rest of the time and ensuring normal blood circulation.

XS Innovations CEO Toon Stilma said: “I am incredibly proud to be part of a team that is dedicated to addressing the root cause of vascular access complications in a novel way. We are determined to accelerate the development of the Dynamic AVF and bring this life-changing device to market. We are committed to improving the lives of patients with kidney failure whilst revolutionizing the field of hemodialysis treatment.”

CSO Joris Rotmans said: “This financing allows us to establish a clear path forward for the introduction of the Dynamic AVF into the clinical care for patients with kidney failure in need for a better vascular access for hemodialysis. These patients suffer short term from high re-operation rates which impact their quality of life, and in the long term, many suffer from severe cardiovascular comorbidity. I am excited about the prospect of creating an alternative for ESKD patients that can address these issues.”

FIRST Fund’s Jaap de Bruin, on behalf of the investor syndicate, stated: “The syndicate is confident that the XSI team has the innovation and know-how to further develop the Dynamic AVF device, supported by a strong advisory board. We believe that the Dynamic AVF can have a transformative effect on the outcomes and quality of life in patients receiving dialysis care.

About Delft Enterprises

Delft Enterprises participates in innovative, early stage and technology-based spin off companies of Delft University of Technology. We aim to empower and speed up the development of these startups, as part of the ambition of the university to turn scientific knowledge into economic and social value. We achieve this through investment, advice and a broad network of investors and experts.

About FIRST Fund

Fonds InvesteringsRijpe STarters (FIRST) is a pre-seed fund that finances pioneering scientists in The Netherlands active in the emerging fields of regenerative medicine and cardiovascular diseases. FIRST is founded by the Dutch Cardiovascular Alliance (DCVA) and Regenerative Medicine Crossing Borders (RegMed XB) with support of the Netherlands Enterprise Agency. BioGeneration Ventures (BGV) supports the FIRST fund as registered fund manager, making available its network, expertise, and facilities. For more information: www.biogenerationventures.com/first

About Medtech TTT

The Thematic Technology Transfer Medtech consortium is a cooperative alliance between Technology Transfer Offices of the four Dutch Technical Universities, three academic medical centers and Innovation Industries. It was founded to help promising early-stage tech spin-offs in making an important step to growth and market penetration. The TTT Medtech Fund is managed by Innovation Industries.

About UNIIQ

UNIIQ is a EUR 50 million investment fund focused on the proof-of-concept phase. UNIIQ assists entrepreneurs in the Dutch province Zuid-Holland in bringing their unique innovations to market faster. We provide entrepreneurs with the seed capital to realize their plans and bridge the most risky phase from concept to promising company. UNIIQ was founded in 2016 by TU Delft, Erasmus MC, Leiden University, and regional development agency InnovationQuarter. UNIIQ is managed by a team of investment professionals in which the partnering institutions are represented. In 2021, Erasmus University joined the fund. UNIIQ is made possible in part by the European Union, the province of Zuid-Holland and the municipalities of Rotterdam, The Hague and Leiden.

About LEH

Libertatis Ergo Holding B.V. is an independent, wholly owned subsidiary of Leiden University which creates, supports and invests in startup and spinout companies related to Leiden University’s activities. LEH currently supports about 40 startup and spinout companies aimed at increasing the impact of Leiden University.

About Graduate Entrepreneur Fund

Graduate Entrepreneur is a VC fund investing in pre-seed and seed ventures, providing both funding and support to the founders. It was founded three years ago by alumni from Erasmus University Rotterdam, Erasmus MC and TU Delft.